RBA’s solution to inflation? ‘Some people will have to sell their homes’

The Australian Bureau of Statistics (ABS) released national accounts figures for the three months ending June on September 5.

The data showed that the economy grew by just 0.2% during the quarter and only 1.5% for the 2023-24 financial year. If it were not for population growth — mostly migration — the economy would have contracted and talk would be of a recession.

Curiously, despite the economy barely growing, official interest rates, set by the Reserve Bank of Australia (RBA), remain high and there seems little expectation of a cut, at least in the short term.

In fact, RBA Governor Michelle Bullock warned that some would be forced to sell their homes, as the pressure of high interest rates and a persistently high cost of living made it impossible for them to service the mortgage.

According to the World Bank, the global capitalist economy has been battling an inflation crisis, which peaked in July 2022.

Inflation in Australia peaked in December 2022, at 7.8%, but subsequently declined to 3.8% in June.

The causes of inflation are contested.

The Australia Institute (TAI) has provided compelling evidence to show that company profits have been the main cause of inflation (up to 60%), while increased labour costs (wages) have only accounted for around 15% of the increase.

The RBA, however, continues to blame workers.

In its February 2024 Statement on Monetary Policy, it said: “Goods price inflation has declined but services price inflation remains high, supported by continued excess demand in the economy and strong domestic cost pressures, both for labour and non-labour inputs.”

In other words, while the price of the things we buy may be moderating, the cost of services (including hospitality and entertainment) is continuing to rise, and the RBA blames wages.

The RBA explained what it wants to achieve in its August Statement on Monetary Policy.

“The unemployment rate increased as expected to 4.1 per cent in June, 0.6 percentage points above its late-2022 trough,” on the back of higher interest rates and a contracting economy.

The methods used by the RBA, in the service of the ruling class, are crude but effective, and are not limited to mortgage rates.

A key part of the RBA’s strategy is also to raise unemployment and therefore drive down wage pressures.

Karl Marx explained that there is an inverse relationship between wages and unemployment: as the size of the reserve army of labour grows, it creates greater competition among working people, meaning that bosses are less likely to agree to higher wages.

Unemployment was only 3.5% in December 2022. In July, unemployment had risen to 4.2% and was again on an upward trend, following months of higher interest rates.

It should come as no surprise.

The RBA’s economic shonks even have an acronym for it — NAIRU: the non-accelerating inflation rate of unemployment, which is defined as “the lowest unemployment rate that can be sustained without causing wages growth and inflation to rise”.

The fact that there is no agreed number for NAIRU or, in fact, that there is strong evidence that wages are not the cause of inflation, does not stop the RBA’s crusade to drive down wage increases and push-up unemployment.

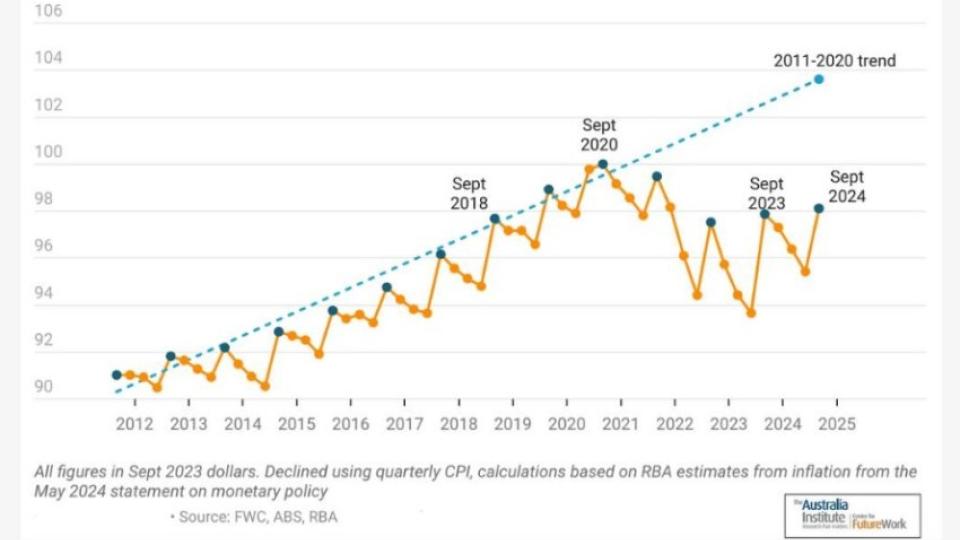

TAI has shown that even after recent wage rises, real wages will remain below what they were before the pandemic.

Every crisis is an opportunity for the capitalist class to drive down costs, particularly by reducing wage rises.

“What’s required is productivity-enhancing micro-economic reforms,” according to the Sydney Morning Herald’s Stephen Bartholeusz.

“Business calls for less regulation and faster approvals for new investments might help, but there is a larger and more complex national conversation that should be had as a matter of urgency,” he said on September 5.

Greater productivity, it seems, is the aim of the capitalist class (i.e. working harder and longer for less) and the surest way to achieve that is by increasing unemployment and driving down wages growth.

What a difference a year makes. On September 12 last year, multimillionaire property developer Tim Gurner demanded that unemployment needed to increase by 40 to 50%, as workers had become “too arrogant”, especially in the construction sector. Having spoken the quiet part out loud, Gurner apologised.

Now the villain has become the hero.

At the time of Gurner’s comments, national employment was 3.6%: it’s now 4.2% (a rise of 17% and increasing) and the Construction Division of the Construction Forestry Maritime Employees Union is in administration.

Capitalism has long ceased to provide for the majority, yet its institutions (government, the RBA and the corporate media) continue to try to tell us that there is no alternative.

Solidarity is the only way forward, as working people we are in this together and we will only resist further attacks on our living standards by staying united.

[Graham Matthews is a member of the Socialist Alliance.]